UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| [X] | Filed by the Registrant |

| [ ] | Filed by a party other than the Registrant |

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material under § 240.14a-12 |

HopTo, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1. | Title of each class of securities to which transaction applies: | |

| 2. | Aggregate number of securities to which transaction applies: | |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4. | Proposed maximum aggregate value of transaction: | |

| 5. | Total fee paid: |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1. | Amount Previously Paid: | |

| 2. | Form, Schedule or Registration Statement No.: | |

| 3. | Filing Party: | |

| 4. | Date Filed: |

October 24, 2019November 29, 2021

Dear Fellow Stockholders:

We invite you to join us at the 20192021 Annual Stockholders’ Meeting (the “Annual Meeting”) of HopTo.HopTo, Inc., on Thursday, November 14, 2019,December 21, 2021, beginning at 9:00 a.m. local time, at 3366 Via Lido,620 Newport Center Drive, 11th Floor, Newport Beach, CA 92663.92660.

The Notice of Annual Stockholders’ Meeting, proxy statement and proxy statementcard accompanying this letter provide an outline of the business to be conducted at the meeting.

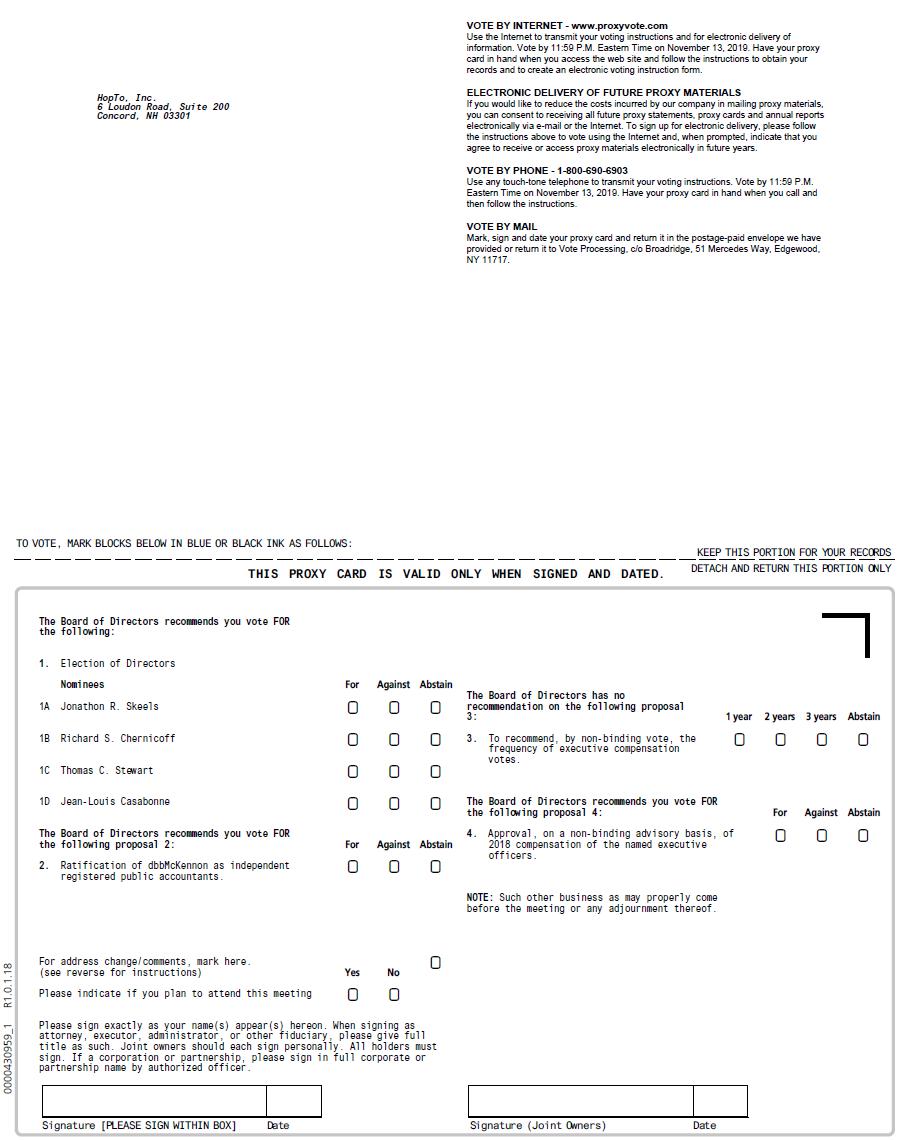

It is important that you be represented at the Annual Meeting. Please complete, sign, date and return the proxy card to us in the enclosed envelope. If a broker or other nominee holds your shares in “street name,” your broker has enclosed a voting instruction form, which you should use to vote those shares. The voting instruction form indicates whether you have the option to vote those shares by telephone or by using the internet. We urge you to fill out, sign, date and mail the enclosed proxy card or authorize your proxy by telephone or through the internet as soon as possible, even if you currently plan to attend the Annual Meeting. This will not prevent you from voting in person, but will assure that your vote is counted if you are unable to attend the meeting. Your vote and participation in the governance of HopTo, Inc. are very important to us.

On behalf of your Board of Directors, thank you for your continued support.

Sincerely yours,

/s/ Jonathon R. Skeels

Jonathon R. Skeels

Chief Executive Officer, Interim Chief Financial Officer, Secretary and Member of Board of Directors

Hop To,HopTo, Inc.

Notice of Annual Stockholders’ Meeting

The 20192021 Annual Stockholders’ Meeting (the “Annual Meeting”) of HopTo, Inc., a Delaware corporation (the “Corporation”), will be held on November 14, 2019,December 21, 2021, beginning at 9:00 a.m. local time, at 3366 Via Lido,620 Newport Center Drive, 11th Floor, Newport Beach, CA 92663.92660.

The following matters will be considered at the Annual Meeting:

| ● | The election of each of Jonathon R. Skeels, | |

| ● | The ratification of the selection of dbbMcKennon to serve as the Corporation’s independent registered public accounting firm for the fiscal year ending December 31, | |

| ● | The approval, on an advisory basis, of the | |

| ● | Other matters that may properly come before the Annual Meeting. |

The items to be considered at the Annual Meeting may be considered at the meeting or at any adjournment or postponement of the meeting.

You are entitled to vote at the Annual Meeting, or at any adjournment or postponement thereof, only if you were a stockholder of the Corporation at the close of business on October 11, 2019November 1, 2021 (the “Record Date”). You are entitled to attend the Annual Meeting, or any adjournment or postponement thereof, only if you were a stockholder at the Record Date or you hold a valid proxy to vote at the meeting.Annual Meeting. You must present photo identification and proof of ownership and proxy representation to be admitted to the meeting.Annual Meeting.

Whether or not you expect to attend the Annual Meeting, please vote your shares in advance online, by phone or by mail to ensure that your vote will be represented at the Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Annual Meeting, you must obtain a proxy issued in your name from that record holder.

Jonathon R. Skeels

Chief Executive Officer, Interim Chief Financial Officer, Secretary and Member of Board of Directors

Concord, New Hampshire

October 24, 2019November 29, 2021

Important Notice Regarding the Availability of Proxy Statement Materials for the

Annual Stockholders’ Meeting to be Held on November 14, 2019.December 21, 2021.

The Proxy Statement, Proxy Card and Our Annual Report Onon Form 10-K

are available on the Internetinternet at www.proxyvote.com.

This proxy statement and the accompanying form of proxy or voting instruction card and our 20182020 Annual Report on Form 10-K are being provided to stockholders beginning on or about October 24, 2019.November 29, 2021.

TABLE OF CONTENTS

| i |

PROXY STATEMENTHOPTO, INC.

20192021 ANNUAL STOCKHOLDERS’ MEETING

TO BE HELD ONNovember 14, 2019 DECEMBER 21, 2021

We are furnishing you this proxy statement in connection with the solicitation of proxies by the Board of Directors (the “Board”) of HopTo, Inc., a Delaware corporation (the “Corporation”, the “Company”, “we”, “us”, or “our”). This proxy statement addresses the items of business for the 20192021 Annual Stockholders’ Meeting of the Corporation (the “Annual Meeting”) to be held on November 14, 2019,December 21, 2021 or any postponement or adjournment thereof. We will hold the Annual Meeting at 9:00 a.m., at our 3366 Via Lido,620 Newport Center Drive, 11th Floor, Newport Beach, CA 92663.92660. The Notice of Annual Stockholders’ Meeting, this proxy statement, our Annual Report on Form 10-K for the fiscal year ended December 31, 2018, the2020, a proxy card and any other accompanying proxy materials are being made available to our stockholders on or about October 24, 2019.November 29, 2021.

Proxy Materials

1. Why am I receiving these materials?

Our Board of Directors is making these materials available to you over both the Internetinternet and by mailing paper copies to you in connection with the Annual Meeting to be held on November 14, 2019.December 21, 2021. As a stockholder, you are invited to attend the Annual Meeting and are entitled and requested to vote on the business itemsproposals described in this proxy statement. This proxy statement includes information that we are required to provide under the rules of the Securities and Exchange Commission (the “SEC”) and is designed to assist you in voting your shares.

2. What is included in the proxy materials?

The proxy materials include:

| ● | Our Notice of Annual Stockholders’ Meeting; | |

| ● | Our proxy statement for the Annual Meeting; | |

| ● | Our | |

| ● | Our proxy |

3. What information is contained in this proxy statement?

The information in this proxy statement relates to the proposals to be voted on at the Annual Meeting, the voting process, our Board of Directors and boardits committees, corporate governance, the compensation of our directors and executive officers, and other required information.

4. I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy?

If you share an address with another stockholder, you may receive only one set of proxy materials unless you have provided contrary instructions. If you wish to receive a separate set of the materials, please request thean additional copy by contacting Householding Department, 51 Mercedes Way, Edgewood, NY 11717 or by calling (866) 540-7095.

A separate set of the materials will be sent promptly following receipt of your request.

| 1 |

If you are a stockholder of record and wish to receive a separate set of proxy materials in the future, or if you have received multiple sets of proxy materials and would like to receive only one set in the future, please contact our transfer agent, American Stock Transfer and Trust Company, at 6201 15th15th Avenue, Brooklyn NY 11219 or by calling (718) 921-8300.

If you are a beneficial owner of shares and you wish to receive a separate set of proxy materials in the future, or if you have received multiple sets of proxy materials and would like to receive only one set in the future, please contact your bank or broker directly.

Stockholders also may write to, or email us, at the address below to request a separate copy of the proxy materials:

HopTo, Inc.

6 Loudon Road,189 N Main Street, Suite 200102

Concord NH 03301

Attn: Investor Relations

investors@hopto.com

5. Who pays the cost of soliciting proxies for the Annual Meeting?

We are making this solicitation and will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials and of soliciting proxies.

Our directors, officers and employees also may solicit proxies in person, by telephone or by electronic communication. They will not receive any additional compensation for these activities.

We will reimburse brokerage houses and other custodians, nominees and fiduciaries for forwarding proxy materials to beneficial stockholders.

6. What items of business will be voted on at the Annual Meeting?

The business itemsproposals to be voted on at the Annual Meeting are:

| ● | ||

| ● | ||

| ● | ||

| ● |

7. What are my voting choices?

You may vote “FOR” or “AGAINST” the election of any or all nominees for election as director; and you may vote “FOR” or “AGAINST”director, the ratification of the selection of dbbMcKennon and the approval, on an advisory vote onbasis, of the 20182020 compensation of our named executive officers. With respect to the advisory vote on the frequency of stockholder advice on the compensation of our named executive officers, you may vote for one year, two years or three years.

| 2 |

8. How does the Board of Directors recommend that I vote?

Our Board of Directors recommends that you vote your shares “FOR” each of its nominees for election to the board; “FOR” the ratification of the Corporation’s independent registered public accounting firm; and “FOR” the approval, on an advisory basis, of the 20182020 compensation of our named executive officers. The Board of Directors is not required to make a recommendation with respect to the frequency of a stockholder advisory vote on the compensation of our name Executive Officers and has chosen not to make a recommendation with respect to that proposal.

9. What vote is required to approve each item?

To conduct business at the Annual Meeting, a quorum must be established. Pursuant to our Second Amended and Restated Bylaws (our “Bylaws”), a quorum is established by the presence in person or by proxy, of holders of a majority of our outstanding stock and entitled to vote thereat.

If you indicate “ABSTAIN,” your vote will be counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting, but will not be considered a vote cast with respect to the election of any director nominee or any other proposal. You are not entitled to cumulative voting in the election of directors.

As described below, broker non-votes will be counted for determining the presence or absence of a quorum for the transaction of business at the Annual Meeting, but will not be considered votes cast with respect to the election of any director nominee or any other proposal.

| Proposal | Required Vote | |

| 1. Election of directors | Plurality of the shares present and voting | |

| 2. Ratification of independent registered public accounting firm | Majority of the shares present and voting | |

| 3. Advisory vote on executive compensation | Majority of the shares present and voting |

With respectFor the election of directors, the three nominees receiving the most “FOR” votes from the holders of shares present in person or represented by proxy and entitled to vote for the advisoryelection of directors will be elected. Only votes “FOR” or “WITHHELD” will affect the outcome. Broker non-votes will have no effect.

The ratification of the selection of dbbMcKennon as our independent registered public accounting firm for the fiscal year ending December 31, 2021 must receive “FOR” votes from at least a majority of shares present in person or by proxy and entitled to vote on such proposal. Abstentions will have the frequencysame effect as a vote against such proposal. Broker non-votes will have no effect.

The advisory approval of stockholder advice on the compensation of our named executive officers our Boardmust receive “FOR” votes from at least a majority of Directors has decidedshares represented either present in person or represented by proxy and entitled to adoptvote at the frequency that receivesAnnual Meeting. Abstentions from voting will have the greatest level of support from our stockholders.same effect as a vote against the proposal. Broker non-votes will have no effect.

| 3 |

10. What happens if additional items are presented at the Annual Meeting?

We are not aware of any item that may be voted on at the Annual Meeting that is not described in this proxy statement. However, the holders of the proxies that we are soliciting will have the discretion to vote them in accordance with their best judgment on any additional matters that may be voted on, including matters incidental to the conduct of the meeting.Annual Meeting.

11. Is my vote confidential?

You may elect that your identity and individual vote be held confidential by marking the appropriate box on your proxy card or ballot. ConfidentialityConfidential elections will not apply to the extent that voting disclosure is required by law or is necessary or appropriate to assert or defend any claim relating to voting.

Confidentiality will also not apply with respect to any matter for which votes are solicited in opposition to the director nominees or voting recommendations of our Board, of Directors, unless the persons engaging in the opposing solicitation provide stockholders with confidential voting comparable to that which we provide.

12. Where can I find the voting results?

We expect to announce preliminary voting results at the Annual Meeting and to publish final results in a Current Report on Form 8-K that we will file with the SEC within four business days following the meeting. The report will be available on our website at www.hopto.com.

13. What shares can I vote?

You are entitled to one vote for each share of our common stock that you owned at the close of business on October 11, 2019,November 1, 2021, the record date for the Annual Meeting (the “Record Date”) and any adjournment or postponement thereof.. You may vote all shares owned by you on the Record Date, including (1) shares held directly in your name as the stockholder of record and (2) shares held for you as the beneficial owner through a bank, broker or other nominee. On the Record Date, 9,834,86618,850,675 shares of our common stock were outstanding.

14. What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Most of our stockholders hold their shares through a bank, broker or other nominee rather than having the shares registered directly in their own name. Summarized below are some distinctions between shares held of record and those owned beneficially.

Stockholder of Record

If your shares are registered directly in your name with our transfer agent, you are the stockholder of record of the shares. As the stockholder of record, you have the right to grant a proxy to vote your shares to representatives fromof the Corporation or to another person, or to vote your shares in person at the Annual Meeting, or any adjournment or postponement thereof. You have received either a proxy card to use in voting your shares or a notice of Internetinternet availability of our proxy materials, which instructs you how to vote.

Beneficial Owner

If your shares are held through a bank, broker or other nominee, it is likely that they are registered in the name of the nominee and you are the beneficial owner of shares held in street name.

As the beneficial owner of shares held for your account, you have the right to direct the registered holder to vote your shares as you instruct, and you also are invited to attend the Annual Meeting. Your bank, broker, plan trustee or other nominee has provided a voting instruction card for you to use in directing how your shares are to be voted. However, since a beneficial owner is not the stockholder of record, you may not vote your shares in person at the Annual Meeting, or any adjournment or postponement thereof, unless you obtain a legal proxy from the registered holder of the shares giving you the right to do so.

| 4 |

15. How can I vote in person at the Annual Meeting?

You may vote in person at the Annual Meeting, or any adjournment or postponement thereof, those shares that you hold in your name as the stockholder of record. You may vote in person shares for which you are the beneficial owner only by obtaining a legal proxy giving you the right to vote the shares from the bank, broker or other nominee that is the registered holder of your shares.

Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions as described below so that your vote will be counted if you later decide not to attend.

16. How can I vote without attending the Annual Meeting?

Whether you hold your shares as a stockholder of record or as a beneficial owner, you may direct how your shares are to be voted without attending the Annual Meeting, or any adjournment or postponement thereof. If you are a stockholder of record, you may vote by submitting a proxy. If you hold shares as a beneficial owner, you may vote by submitting voting instructions to the registered owner of your shares.

For directions on how to vote, please refer to the following instructions and those included on your proxy or voting instruction card.

Voting by Internet. Stockholders may vote over the Internetinternet by following the instructions on the proxy or voting instruction card.

Voting by Telephone. Stockholders of record may vote by telephone by calling (800) 690-6903 and following the instructions. When voting by telephone, stockholders must have available the control number included on their proxy card.

Most stockholders who are beneficial owners of their shares may vote by phone by calling the number specified on the voting instruction card provided by their bank, broker or nominee. These stockholders should check the card for telephone voting availability.

Voting by Mail. Stockholders may vote by mail by signing, dating and returning their proxy or voting instruction card.

17. How will my shares be voted?

Your shares will be voted as you specifically instruct on your proxy or voting instruction card. If you sign and return your proxy or voting instruction card without giving specific instructions, your shares will be voted in accordance with the recommendations of our Board of Directors and in the discretion of the proxy holders on any other matters that properly come before the meeting.

18. Will shares I hold in my brokerage account be voted if I do not provide timely voting instructions?

If your shares are held through a brokerage firm, they will be voted as you instruct on the voting instruction card provided by your broker. If you sign and return your card without giving specific instructions, your shares will be voted in accordance with the recommendations of our Board of Directors and in the discretion of the proxy holders on any other matter that properly comes before the Annual Meeting.

If you do not provide timely instructions as to how your brokerage shares are to be voted, your broker will have the authority to vote them only on the proposal to ratify the appointment of our independent registered public accounting firm. Your broker will be prohibited from voting your shares on any of the other proposals. These “broker non-votes” will be counted only for the purpose of determining whether a quorum is present at the meeting and not as votes cast.

| 5 |

19. Will shares that I own as a stockholder of record be voted if I do not timely return my proxy card?

Shares that you own as a stockholder of record will be voted as you instruct on your proxy card. If you sign and return your proxy card without giving specific instructions, they will be voted in accordance with the recommendations of our Board of Directors and in the discretion of the proxy holders on any other matter that properly comes before the Annual Meeting.

If you do not timely return your proxy card, your shares will not be voted unless you or your proxy holder attends the Annual Meeting and any adjournment or postponement thereof and votes in person as described in Question 15.

20. When is the deadline to vote?

If you hold shares as the stockholder of record, your vote by proxy must be received before the polls close at the Annual Meeting and any adjournment or postponement thereof.

If you hold shares as a beneficial owner, please follow the voting instructions provided by your bank, broker or other nominee.

21. May I change or revoke my vote?

You may change your vote at any time prior to the vote at the Annual Meeting.

If you are a stockholder of record, you may change your vote by granting a new proxy bearing a later date (which automatically revokes the earlier proxy), by providing a written notice of revocation to our Corporate Secretary at the address in Question 24 prior to your shares being voted, or by attending the Annual Meeting and voting in person. Attendance at the meetingAnnual Meeting will not cause your previously granted proxy to be revoked unless you specifically so request.

For shares you hold as a beneficial owner, you may change your vote by timely submitting new voting instructions to your bank, broker or other nominee (which revokes your earlier instructions), or, if you have obtained a legal proxy from the nominee giving you the right to vote your shares, by attending the Annual Meeting and voting in person.

22. Who will serve as inspector of elections?

The inspector of elections will be a representative of the Company.

23. Who can attend the Annual Meeting?

You may attend the Annual Meeting and any adjournment or postponement thereof only if you were a stockholder of ours at the close of business on the Record Date, or you hold a valid proxy to vote at the meeting.Annual Meeting. You should be prepared to present photo identification to be admitted to the meeting.Annual Meeting.

If you are not a stockholder of record but are the beneficial owner of shares held in street name through a bank, broker or other nominee, in order to be admitted to the meetingAnnual Meeting you must provide proof of beneficial ownership on the Record Date, such as your most recent account statement that includes the Record Date, a copy of the voting instruction card provided by your nominee, or other similar evidence of share ownership.

The meeting will begin promptly at 9:00 a.m., local time. Please allow ample time for check-in procedures.

| 6 |

Stockholder Proposals and Director Nominations

24. What is the deadline to submit stockholder proposals to be included in the proxy materials for next year’s Annual Stockholders’ Meeting?

Stockholder proposals that are intended to be included in our proxy materials for next year’s Annual Stockholders’ Meeting must be received by our Corporate Secretary no later than June 25, 2020August 1, 2022 and must be submitted to Corporate Secretary, HopTo, Inc., 6 Loudon Road,189 N. Main Street, Suite 200,102, Concord NH 03301.

Proposals that are not timely submitted by June 25, 2020August 1, 2022 or are submitted to the incorrect address or other than to the attention of our Corporate Secretary will be considered untimely and may, at our discretion, be excluded from our proxy materials. Stockholder proponents must meet the eligibility requirements of the SEC’s Stockholder Proposal Rule (Rule 14a-8), and their proposals must comply with the requirements of that rule to be included in our proxy materials.

See Question 25 for a description of the procedures in our Bylaws through which stockholders may nominate and include director candidates in our proxy statement.

25. How may I nominate director candidates or present other business for consideration at an Annual Stockholders’ Meeting?annual stockholders’ meeting?

Stockholders who wish to (1) submit director nominees for inclusion in our proxy materials for next year’s Annual Stockholders’ Meetingannual stockholders’ meeting or (2) present other items of business directly at next year’s Annual Stockholders’ Meetingannual stockholders’ meeting must give written notice of their intention to do so in accordance with the deadlines described below to our Corporate Secretary at the address set forth in Question 24. Any such notice also must include the information required by our Bylaws (which may be obtained as provided in Question 27) and must be updated and supplemented as provided in the Bylaws.

Notice of director nominees, or for the presentation of other items of business, submitted must be received not less than ninety days nor more than 120 days prior to the first anniversary of the preceding year’s Annual Stockholders’ Meeting.annual stockholders’ meeting. The period for the receipt from stockholders of any such notice for the 2020 Annual Stockholders’ Meeting2022 annual stockholders’ meeting is currently set to begin on July 17, 2020August 23, 2022 and end on August 17, 2020.September 23, 2022.

These above-mentioned notice requirements applicable under our advance notice BylawBylaws provisions do not apply to stockholder proposals intended for inclusion in our proxy materials under the SEC’s Stockholder Proposal Rule (Rule 14a-8). The deadline for receiving those proposals is set forth in Question 24.

26. How may I recommend candidates to serve as directors?

Stockholders may recommend director candidates for consideration by the Board for our 2022 Annual Meeting of Directorsstockholders by writing to our Corporate Secretary at the address set forth in Question 24. A recommendation must be accompanied by a statement from the candidate that he or she would give favorable consideration to serving on our Board of Directors and should include sufficient biographical and other information concerning the candidate and his or her qualifications to permit the committeeBoard to make an informed decision as to whether further consideration of the candidate would be warranted.

| 7 |

Obtaining Additional Information

27. How may I obtain financial and other information about the Corporation?

Our consolidated financial statements are included in our 20182020 Annual Report on Form 10-K that accompanies this proxy statement.

We file our Annual Report on Form 10-K (the “Form 10-K”) with the SEC, located at 100 F Street, N.E., Washington, D.C. 20549. Our20549, and our filings with the SEC can be accessed via the SEC’s website, www.sec.gov. The Form 10-K and other information that we file with the SEC are available on our website at www.hopto.com. We also will furnish a copy of our 2018the Form 10-K (excluding exhibits, except those that are specifically requested) without charge to any stockholder who so requests by writing to our Corporate Secretary at the address in Question 24.

By writing to us, stockholders also may obtain, without charge, a copy of our Bylaws, corporate governance guidelines, codes of conduct and board standingBoard committee charters. You also can view these materials on the Internetinternet by accessing our website at www.hopto.com.

28. What if I have questions for HopTo’s transfer agent?

If you are a stockholder of record and have questions concerning share certificates, dividend checks, ownership transfer or other matters relating to your share account, please contact our transfer agent, American Stock Transfer and Trust Company, at the following address 6201 15th15th Avenue, Brooklyn NY 11219, or by calling (718) 921-8300.

29. How do I get additional copies of this proxy statement or voting materials?

If you need additional copies of this proxy statement or voting materials, please contact us at:

HopTo, Inc.

6 Loudon Road,189 N. Main Street, Suite 200102

Concord NH 03301

Attn: Investor Relations

investors@hopto.com

| 8 |

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of the Record Date, certain information regarding the beneficial ownership of our common stock by:

| ● | each of the directors and named executive officers for the fiscal year ended December 31, | |

| ● | all of our current executive officers, director nominees and directors as a group; and | |

| ● | each person known by us to be beneficial owners of 5% or more of our outstanding common stock. |

Except as indicated in the footnotes to this table and under applicable community property laws, to our knowledge, the persons named in the table have sole voting and investment power with respect to all shares of common stock. For the purposes of calculating percent ownership, as of the Record Date, approximately 9,834,86618,850,675 shares of common stock were issued and outstanding, and, for any individual who beneficially owns shares represented by options exercisable within sixty days of the Record Date, these shares are treated as if outstanding for that person, but not for any other person.

| Name and Address | Number of Shares of | Percent of Class (%) | ||||||

| Jean-Louis Casabonne (3) | 61,244 | 0.6 | * | |||||

| Jonathon R. Skeels (4) | 1,326,927 | 13.5 | ||||||

| Thomas C. Stewart (5) | 120,000 | 1.2 | ||||||

| Richard C. Chernicoff | — | — | ||||||

| All current executive officers and directors as a group (4 persons) | 1,508,171 | 15.3 | ||||||

| JMI Holdings, LLC (2011 Family Series) (6) | 936,232 | 9.1 | ||||||

David R. Wilmerding, III (7) 2 Hamill Road, Suite 272 Baltimore, MD 21117 | 961,010 | 9.3 | ||||||

Jon C. Baker (8) 101 St. Johns Road Baltimore, MD 21210 | 894,377 | 8.7 | ||||||

Austin Marxe, David Greenhouse and Adam C. Stettner (9) 527 Madison Avenue, Suite 2600 New York, NY 10022 | 912,657 | 8.8 | ||||||

Novelty Capital Partners LP (4) 620 Newport Center Drive, 11th Floor Newport Beach, CA 92660 | 1,326,927 | 13.5 | ||||||

Unless otherwise indicated, the address of each beneficial owner listed in the table below is c/o HopTo, Inc., 189 N. Main Street, Suite 102, Concord NH 03301.

| Name and Address | Number of Shares of Common Stock Beneficially Owned (1) | Percent of Class (%)(2) | ||||||

| Jean-Louis Casabonne (3) | 56,769 | * | ||||||

| Jonathon R. Skeels (4) | 8,388,118 | 44.5 | % | |||||

| Thomas C. Stewart (5) | 173,436 | * | ||||||

| Richard C. Chernicoff (6) | 53,436 | * | ||||||

| All current executive officers and directors as a group (4 persons) | 8,671,759 | 46.0 | % | |||||

| JMI Holdings, LLC (2011 Family Series) (7) 111 Congress Avenue, Suite 2600 Austin, TX 78701-4062 | 1,713,843 | 9.1 | % | |||||

| David R. Wilmerding, III (8) 2 Hamill Road, Suite 272 Baltimore, MD 21117 | 961,010 | 5.1 | % | |||||

| Austin Marxe, David Greenhouse and Adam C. Stettner (9) 527 Madison Avenue, Suite 2600 New York, NY 10022 | 1,245,989 | 6.6 | % | |||||

| Novelty Capital Partners LP (4) 620 Newport Center Drive, 11th Floor Newport Beach, CA 92660 | 8,388,118 | 44.5 | % | |||||

| * | Less than 1%. |

| (1) | As used in this table, beneficial ownership means the sole or shared power to vote, or direct the voting of, a security, or the sole or shared power to invest or dispose, or direct the investment or disposition, of a security. Except as otherwise indicated, based on information provided by the named individuals, all persons named herein have sole voting power and investment power with respect to their respective shares of our common stock, except to the extent that authority is shared by spouses under applicable law, and record and beneficial ownership with respect to their respective shares of our common stock. With respect to each stockholder, any shares issuable upon exercise of options and warrants held by such stockholder that are currently exercisable or will become exercisable within 60 days of the Record Date are deemed outstanding for computing the percentage of the person holding such options, but are not deemed outstanding for computing the percentage of any other person. |

| 9 |

| (2) | Percentage ownership of our common stock is based on |

| (3) | Based on information contained in Form 4 filed on |

| (4) | Based on information contained in Form 4 filed on |

| (5) | Based on information contained in Form 4 filed on |

| (6) | Based on information contained in Form 4 filed on August 20, 2020, Richard S. Chernicoff owns 53,436 shares of our common stock. |

| (7) | Based solely on information known to us, Charles E. Noell, III, John J. Moores and Bryant W. Burke share voting and dispositive power over these shares by virtue of being members of El Camino Advisors, LLC, the manager of JMI Holdings, LLC (2011 Family Series). JMI Holdings, LLC (2011 Family Series) owns |

(8) (9) | Based on information contained in a Schedule 13G/A filed by David Wilmerding on January |

Based | |

| 10 |

Proposals 1, 2 3 and 43 are included in this proxy statement at the direction of our Board of Directors.Board. Our Board of Directors recommends that you vote “FOR” each nominee in Proposal 1 and “FOR” each of Proposals 2 and 4. The Board of Directors makes no recommendations with respect to Proposal 3.

Proposal 1: Election of Directors

OurBoard of Directors currently has four members. Our second amended and restated bylaws provide that the number of directors shall be fixed from time to time by resolution of our Board of Directors. Directors are elected at each Annual Stockholders’ Meetingannual stockholders’ meeting for terms expiring at the next Annual Stockholders’ Meeting.annual stockholders’ meeting. Our Board of Directors has nominated the following fourthree individuals for election as directors, all of whom currently are directors:members of our Board. Jean-Louis Casabonne will retire from the Board of Directors at the 2021 Annual Meeting of Stockholders and accordingly the Board of Directors has determined to set the number of directors at three. The Board has determined not to seek a replacement director for Mr. Casabonne at this time and as a result has fixed the number of directors at three.

| Director/Nominee | Age | ||||||||

| Jonathon R. Skeels | 39 | ||||||||

| Thomas C. Stewart | 53 | ||||||||

| Richard S. Chernicoff | 56 |

Since September 2018, our Board of Directors has managed its affairs as a whole and, given the scope of our business and the size of our Board, of Directors has not found it necessary to subdivide into committees. It isWe intend to reconstitute the intentionaudit committee and compensation committee when the complexity of the Board to form a separate Audit Committee and Compensation Committee in accordance with the standards established by the Nasdaq Stock Market (“Nasdaq”).our business or legal or listing rules require such committees.

Properly executed proxies will be voted for these fourthree nominees, unless other instructions are specified. If any nominee should become unavailable to serve, the proxies may be voted for a substitute nominee designated by our Board, of Directors, or our Board of Directors may reduce the authorized number of directors. In no event may the proxies be voted for more than seventhree nominees. Election of directors requires the receipt of “FOR” votes constituting a plurality of the votes cast for each nominee at the Annual Meeting, assuming a quorum is present.

Our Board of Directors determined that each non-employee nominee, except Mr. SkeelsMessrs. Stewart and Mr. Casabonne,Chernicoff is an independent director. Our Board of Directors determines the independence of our directors by applying independence principles and standards established by Nasdaq. Based on these standards, our Board has determined that Mr. Skeels is not independent due to his position as our Chief Executive Officer and interim Chief Financial Officer and Mr. Casabonne is not independent due to his service as Chief Financial Officer of the Corporation in 2017. See “Corporate Governance—Certain Relationships and Related Transactions, and Director Independence.”Officer.

Information about the DirectorsDirector Nominees

Biographical information regarding each director nominee and his qualifications to serve as a director is set forth on the succeeding pages.below. The year shown as election as a director is the year that the director was first elected as one of our directors. Unless otherwise indicated, each director has held his principal occupation or other positions with the same or predecessor organizations for at least the last five years. There are currently no family relationships among any of the Corporation’s director nomineenominees or executive officer.officers. None of our director nominees, directors or executive officers have been involved in any legal proceeding listed in Item 401(f) of Regulation S-K in the past 10 years.

Jonathon R. Skeels has been Chief Executive Officer, Interim Chief Financial Officer and a member of our Board since September 2018. Mr. Skeels is the Founder and Managing Partner of Novelty Capital, LLC, a private investment firm. From September 2012 to June 2014, Mr. Skeels held various executive roles at IP Navigation Group, LLC a leading intellectual property monetization firm. From May 2005 to August 2012, LLC, Mr. Skeels was Vice President and Senior Research Analyst of Davenport & Company, LLC, a financial services firm where he was responsible for investments in publicly-traded technology companies. Mr. Skeels holds a BS from American University in Washington, DC.

| 11 |

Mr. Skeels brings to the CompanyCorporation experience in finance,management and operations of our business, investing in technology companies, finance and capital markets. Mr. Skeels, together with his affiliates, owns approximately 13.5%44.5% of our stock.

Thomas C. Stewart has been a member of our Board since September 2018.Mr. Stewart has been the Co-Founder, Chairman and Chief Financial Officer at Control Plane Corp since October 2019. Mr. Stewart previously served as SecureAuth Corporation’s chief financial officer since May 2007. Mr. Stewart wasChief Financial Officer and a member of SecureAuth Inc.’sthe board of directors at SecureAuth Corporation from May 2007 to September 2017. Mr. Stewart previously held various executive roles at Intel Corporation including Finance Manager Information Technology, 2000-2004 and Marketing Director, EMEA 2004-2007. Mr. Stewart holds a BA from Colorado College and an MBA from University of California at Irvine.

Mr. Stewart brings to the CompanyCorporation experience in leading and growing software businesses and in finance, marketing and operations.

Jean-Louis CasabonneRichard S. Chernicoff has been a member of our Board since September 2018. Mr. Casabonne has been theHe is Chief Operating Officer and Chief Financial Officer of Kobie Marketing, Inc. since July 2017. Previously, Mr. Casabonne had served as our former Chief Financial Officer and Secretary from May 2014 to July 2017. From July 2017 to September 2018 he served on a part-time basis as former Chief Financial Officer, Interim Chief Executive Officer and Secretary. From 2002 to 2011, Mr. Casabonne has served as the Chief Financial Officer of Quova, Inc., and following its sale to Neustar, Inc. he served as a strategic evangelist and director of business development at Neustar, Inc. from 2011 to 2014. From 1996 to 2002, Mr. Casabonne was a founder and controller for Inxight Software, a spin-out from Xerox Corporation. He became CFO and VP of Operations for Inxight in 1999, managing finance, administration, legal affairs, information technology and customer support. From 1992 to 1996, Mr. Casabonne served in a number of senior financial positions for Xerox Corporation’s XSoft Division. Mr. Casabonne received his MBA and BS from Santa Clara University.

Mr. Casabonne brings to the Company experience in finance and accounting, management and operations of technology companies. Mr. Casabonne is an audit committee financial expert under the SEC’s rules.

Richard S. Chernicoff is an employee of SunRise Memory Corp., a private semiconductor company. SinceFrom January 2019 to September 2019, Mr. Chernicoff has served as Chief Financial Officer of Perimeter Medical Imaging, Inc., a private equity-sponsored medical imaging company. Mr. Chernicoff served as a member of the board of directors of Great Elm Capital Group, Inc. from 2014 until 2018, and served as its interim Chief Executive Officer from July 2016 to September 2017. Mr. Chernicoff served as a member of the board of directors of Marathon Patent Group, Inc. from March 2015 to July 2017 and served as its interim general counsel.Previously, Mr. Chernicoff was President of Tessera Intellectual Property Corp. from July 2011 to January 2013. Prior to Tessera, Mr. Chernicoff was President of Unity Semiconductor Corp. Prior to that, Mr. Chernicoff was with SanDisk Corporation where, as Senior Vice President, Business Development, his responsibilities included mergers and acquisitions, financings and joint ventures. Previously, Mr. Chernicoff was a mergers and acquisitions partner in the Los Angeles office of Brobeck, Phleger & Harrison LLP, a corporate lawyer in the Los Angeles office of Skadden, Arps, Slate, Meagher & Flom LLP, a member of the staff of the SEC in Washington, DC and an auditor in the Los Angeles office of Ernst & Young LLP. Mr. Chernicoff holds a BS from California State University, Northridge and a JD from St. John’s University School of Law.

Mr. Chernicoff brings to the CompanyCorporation experience leading businesses and in merger and acquisitions, legal and accounting.finance. Mr. Chernicoff is an audit committee financial expert under the SEC’s rules.

OURFor the election of directors, the three nominees receiving the most “FOR” votes from the holders of shares present in person or represented by proxy and entitled to vote for the election of directors will be elected. Only votes “FOR” or “WITHHELD” will affect the outcome. Broker non-votes will have no effect.

THE BOARD OF DIRECTORS RECOMMENDS YOU VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES NAMED IN THIS PROXY STATEMENT.

| 12 |

Proposal 2: Ratification of Independent Registered Public Accounting Firm

Our Board of Directors believebelieves the continued retention of dbbMcKennon (LLC (“dbbMcKennon”) as our independent registered public accounting firm is in our and our stockholders’ best interest. Ratification requires the receipt of “FOR” votes constituting a majority of the votes cast on the proposal at the Annual Meeting, assuming a quorum is present.

Representatives of dbbMcKennon are not expected to attend the Annual Meeting. Thus, it is not expected that they will have an opportunity to make a statement regarding their services, or be available to respond to questions. Our Board of Directors does not know of any direct or indirect financial interest of dbbMcKennon in US.the Corporation.

Our Board of Directors approved the appointment of dbbMcKennon as our independent registered public accounting firm, effective April 17, 2019, as described further below. Accordingly, and in connection therewith, we dismissed Marcum LLP ((“Marcum”) as our independent registered public accounting firm effective as of that same date.

Marcum’s audit report for the fiscal years ended December 31, 2018 on our consolidated financial statements did not contain an adverse opinion or a disclaimer of opinion, nor was any such report qualified or modified as to uncertainty, audit scope or accounting principles. At no point during the fiscal years ended December 31, 2018 and the subsequent interim period through April 25, 2019 were there any “disagreements” (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions) between the Corporationus and Marcum on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures, which disagreements, if not resolved to the satisfaction of Marcum, would have caused it to make reference to the subject matter of the disagreements in connection with its report. There were no “reportable events” (as defined in Item 304(a)(1)(v) of Regulation S-K) for us that occurred during the fiscal year ended December 31, 2018 and the subsequent interim period through April 25, 2019.

Our Board of Directors engaged dbbMcKennon as our new independent registered public accounting firm effective April 25, 2019 to perform independent audit services for the fiscal year ended December 31, 2019. During the fiscal yearsyear ended December 31, 2018 and the subsequent interim period through April 25, 2019, neither we nor anyone on our behalf consulted dbbMcKennon regarding either:

| ● | the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered with respect to the registrant’s consolidated financial statements in connection with which either a written report or oral advice was provided to the registrant that | |

| ● | any matter that was either the subject of a “disagreement” (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions) or a “reportable event” (as defined in Item 304(a)(1)(v) of Regulation S-K). |

The following table presents aggregate fees billed to us for services rendered by our former auditorsdbbMcKennon and Marcum and Macias Gini & O’Connell LLP for the fiscal years ended December 31, 20182020 and December 31, 2017:2019:

| Category | 2018 | 2017 | 2020 | 2019 | ||||||||||||

| Audit fees | $ | 127,000 | $ | 131,600 | $ | 96,756 | $ | 147,200 | ||||||||

| Audit – related fees | 62,300 | 8,000 | ||||||||||||||

| Audit-related fees | - | - | ||||||||||||||

| Tax fees | 17,000 | 10,000 | 13,000 | 17,900 | ||||||||||||

| Totals | $ | 207,100 | $ | 149,600 | $ | 109,756 | $ | 165,100 | ||||||||

Marcum LLP becameAudit fees include fees associated with our auditor since Macias Gini & O’Connell LLP endedannual audit, the engagementreviews of our quarterly reports on Form 10-Q, and assistance with us on April 28, 2018.and review of documents filed with the SEC. Audit-related fees include consultations regarding revenue recognition and new accounting pronouncements as they related to the financial reporting of certain transactions. Tax fees included tax compliance work and tax consultations.

Audit Committee Pre-Approval Policies and Procedures

Among its other duties, until it constitutes its audit committee, our Audit CommitteeBoard, with the approval of all our independent directors, is responsible for appointing, setting compensation for and overseeing the work of the independent auditor. Our Audit Committeeaudit committee previously established a policy regarding pre-approval of all audit and non-audit services provided by the independent auditor. On an ongoing basis, management communicates specific projects and categories of service for which the advance approval is requested. Since September 2018, our Board of Directors has reviewed these requests and advises management if the committeeBoard approves the engagement of the independent auditor. From time to time, management reports to our Board of Directors regarding the actual spending for such projects and services compared to the approved amounts. All services performed by MarcumdbbMcKennon and Macias Gini & O’Connell LLPMarcum for fiscal years 20182020 and 20172019 were approved in accordance with our Audit Committee’s pre-approval guidelines.

| 13 |

Independent Directors’ Report

Our Board of Directors also has determined that each of the threeour directors named belowRichard S. Chernicoff and Thomas C. Stewart is financially literate and an audit committee financial expert as defined by the rules of the Securities and Exchange Commission.SEC. While the Companywe currently doesdo not have an Audit Committee,audit committee, the three directors named below have been delegated with the authority to determine matters typically associated with an audit committee and the Board of Directors has adopted an audit committee charter, which is posted on our website at www.hopto.com.

Since September 2018, our Board of DirectorsBoard’s responsibilities include appointing our independent registered public accounting firm, pre-approving both audit and non-audit services to be provided by the firm and providing oversight of our financial reporting process. In fulfilling itsthe Board’s oversight responsibilities, our independent directors meet with our independent registered public accounting firm and management to review accounting, auditing, internal controls and financial reporting matters.

It is not our Board of Directors’Board’s responsibility to plan or conduct audits or to determine that our financial statements and disclosures are complete, accurate and in accordance with accounting principles generally accepted in the United States and applicable laws, rules and regulations. Management is responsible for our financial statements, including the estimates and judgments on which they are based, as well as our financial reporting processes, accounting policies, internal accounting controls, disclosure controls and procedures, and risk management. Our independent registered public accounting firm is responsible for performing an audit of our annual financial statements, expressing an opinion as to the conformity of the annual financial statements with accounting principles generally accepted in the United States, expressing an opinion as to the effectiveness of our internal control over financial reporting and reviewing our quarterly financial statements.

Our Board of Directors has discussed with MarcumdbbMcKennon the matters required to be discussed by the rules of the Public Company Accounting Oversight Board Auditing Standard No. 1301, “Communications with Audit Committees,” which requires the independent registered public accounting firm to communicate information to thean audit committee regarding the scope and results of its audit of our financial statements, including information with respect to the firm’s responsibilities under auditing standards generally accepted in the United States, significant accounting policies, management judgments and estimates, any significant unusual transactions or audit adjustments, any disagreements with management and any difficulties encountered in performing the audit and other such matters required to be discussed with the Audit Committeean audit committee by those standards.

Our Board of Directors also received from MarcumdbbMcKennon a report providing the disclosures required by the applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with our Board of Directors concerning independence. Marcum also has discussed its independence with the Audit Committeeour independent directors and confirmed in the report that, in its professional judgment, it is independent of us within the meaning of the federal securities laws.

Our Board of Directors also has reviewed and discussed with our senior management the audited financial statements included in our Annual Report on Form 10-K for the year ended June 30, 2018December 31, 2020 and management’s reports on the financial statements and internal controls. Management has confirmed to our Board of Directors that the financial statements have been prepared with integrity and objectivity and that management has maintained an effective system of internal controls. MarcumdbbMcKennon has expressed its professional opinions that the financial statements conform with accounting principles generally accepted in the United States. In addition, our Chief Executive Officer, who is also our interim Chief Financial Officer, havehas reviewed with the committeeBoard the certifications that were filed with the Securities and Exchange CommissionSEC pursuant to the requirements of the Sarbanes-Oxley Act of 2002 and the policies and procedures management has adopted to support the certifications.

Based on these considerations, the undersigned independent directors and financial experts of the Board have recommended that our audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 20182020 for filing with the Securities and Exchange Commission.SEC.

| Jean-Louis Casabonne | |

| Richard S. Chernicoff | |

| Thomas C. Stewart |

The ratification of the selection of dbbMcKennon as our independent registered public accounting firm for the fiscal year ending December 31, 2021 must receive “FOR” votes from at least a majority of shares present in person or by proxy and entitled to vote on such proposal. Abstentions will have the same effect as a vote against such proposal. Broker non-votes will have no effect.

OURBOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” PROPOSAL 2 RELATING TO THE RATIFICATION OF THE APPOINTMENT OF DBBMCKENNON AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2019.2021.

| 14 |

Proposal 3 —3: Advisory Vote on the Frequency of Vote on Executive Compensation

We are asking stockholders to advise us as to how frequently they wish to cast an advisory vote on the compensation of our named executive officers: once every year, once every two years, or once every three years.

This vote is required by new rules under Section 14A of the Securities Exchange Act of 1934, which were adopted as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act, and is an advisory vote, which means that this proposal is not binding on us. The Board of Directors is not required to, nor is it, making a recommendation regarding the frequency that stockholders should approve. Rather, each stockholder will make his or her own choice among a vote once every year, every two years or every three years. You may also abstain from voting on this item. Although the vote is non-binding, the Board will take into account the outcome of the vote when making future decisions about the frequency for holding an advisory vote on executive compensation and currently intends to implement the frequency which receives the greatest level of support from our stockholders.

Proposal 4: Advisory Vote on the 20182020 Compensation of Our Named Executive Officers

Pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act, we are asking stockholders to approve an advisory resolution on the compensation of the named executive officers, as reported in this proxy statement. This proposal, commonly known as a “say-on-pay” proposal, gives our stockholders the opportunity to express their views on our fiscal 20182020 executive compensation program.

compensation. Significant information onabout our executive pay programcompensation is provided in this proxy statement under the heading “Compensation of Directors and Executive Officers.”

We are asking our stockholders to vote in favor of the following resolution:

“RESOLVED, that the stockholders of HopTo, Inc. approve, on an advisory basis, the compensation of the named executive officers, as disclosed in HopTo, Inc.’s Proxy Statement for the 20182021 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the U.S. Securities and Exchange Commission, including the information under the heading “Compensation of Directors and Executive Officers — Compensation Discussion and Analysis,” the compensation tables and narrative disclosure.”

Approval requires the receipt of “FOR” votes constituting a majority of the votes cast on the proposal at the Annual Meeting, assuming a quorum is present.

To the extent there is a significant vote against the compensation of our named executive officers, we will consider our stockholders’ concerns and our Board of Directors will evaluate what actions may be necessary or appropriate to address those concerns.

The advisory approval of the compensation of our named executive officers must receive “FOR” votes from at least a majority of shares represented either present in person or represented by proxy and entitled to vote at the Annual Meeting. Abstentions from voting will have the same effect as a vote against the proposal. Broker non-votes will have no effect.

OURBOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” PROPOSAL 4.3.

| 15 |

Our business and affairs are managed, and all corporate powers are exercised under the direction of our Board of Directors.Board. Our Board of Directors establishes fundamental corporate policies and oversees our performance and our Chief Executive Officer and the other officers to whom our Board of Directors has delegated authority to manage day-to-day business operations.

Our Board of Directors has adopted corporate governance guidelines that set forth expectations for directors, director independence standards, board committee structure and functions, and other policies for the Corporation’s governance. It also has adopted a Code of Business Conduct that applies to members of our Board, of Directors, our executive officers as well as all of our employees. Until September 2018, several standing and special committees assisted our Board of Directors in carrying out its responsibilities. Each operated under a written charter adopted by our Board of Directors.

Our corporate governance guidelines, standing committee charters, including our Audit and Compensation Committee charters, and codes of conduct are posted on our website at www.hopto.com. Paper copies may be obtained upon request by writing to: Corporate Secretary, 6 Loudon Road,189 N. Main Street, Suite 200,102, Concord NH 03301.

Functions

In addition to its general oversight role, our Board of Directors performs a number of specific functions, including:

| ● | Hiring and firing our | |

| ● | Planning for management succession; | |

| ● | Guiding corporate strategy; | |

| ● | Reviewing and monitoring strategic, financial and operating plans and budgets and their development and implementation by management; | |

| ● | Assessing and monitoring risks and risk-management strategies; | |

| ● | Suggesting, reviewing and approving significant corporate actions; | |

| ● | Reviewing and monitoring processes designed to maintain our integrity, including financial reporting, compliance with legal and regulatory obligations, and relationships with stockholders, employees, customers, suppliers and others; and | |

| ● | Selecting director nominees, appointing board committee members, forming board committees and overseeing effective corporate governance. |

Leadership Structure

Our Board of Directors retains the flexibility to determine on a case-by-case basis whether the positions of Chief Executive Officer and Chairman of the Board should be combined or separated and whether an independent director should serve as Chairman. This flexibility permits our Board of Directors to organize its functions and conduct its business in a manner it deems most effective in then prevailing circumstances. Our Board of Directors has determined that its leadership structure is appropriate in light of our current management framework. Currently, our Chief Executive Officer serves as a director on our Board, of Directorsand the Board does not have a Chairman.

Our Board of Directors believes that its independence and oversight of management is maintained effectively through this flexible leadership structure, our Board of Directors’Board’s composition and sound corporate governance policies and practices.

Director Share Ownership Guidelines

Our Board of Directors has not established director share ownership guidelines. We prohibit shorting our stock by our directors and executive officers.

| 16 |

Board and Committee Meetings; Executive Sessions; Annual Stockholders’ Meetings

At regularly scheduled board and committeeBoard meetings, directors review and discuss management reports regarding our performance, prospects and plans, as well as significant opportunities and immediate issues facing us. At least once a year, our Board of Directors also reviews management’s long-term strategic and financial plans.

The Chief Executive Officer proposes the agenda.agenda for Board meetings. Directors are encouraged to propose agenda items, and any director also may raise at any meeting subjects that are not on the agenda. Information and other materials important to understanding the business to be conducted at Board of Directors and its committee meetings are from time to the extent available, aretime distributed in writing to the directors in advance of the meeting. Additional information may be presented at the meeting. An executive session of independent members of our Board of Directors is held at each regular boardBoard meeting, and any director may call for an executive session at any Board of Directors’ meeting.

During the fiscal year ended December 31, 2018,2020, our Board of Directors held 16five meetings. Each then-director attended either in person or by electronic means all of the meetings of our Board of Directors and Board committees on which they served during fiscal year 2018.2020 except Mr. Casabonne was absent at one of the meetings.

We have not established a policy with respect to Board of Directors nominees attending our Annual Stockholders’ Meetings.annual stockholders’ meetings. Last year, all but one of our Board nominees attended our annual stockholder’s meeting.

Evaluation of Board and Director Performance

Our Board of Directors annually reviews hethe individual performance and qualifications of each director who may wish to be considered for nomination to an additional term.

Risk Oversight

Our Board of Directors is responsible for the general oversight of risks that affect us. Our Board of Directors receives regular reports on our operations from our Chief Executive Officer, as well as other members of management. Our Board of Directors reviews these reports and makes inquiries in their business judgment.

UntilSince September 2018, our Board, with the full participation of Directors also fulfilled itsour independent directors, has handled all oversight role through the operations of its various committees,activities, including our Audit Committee. Our Board of Directors received periodic reports on each committee’s activities. Our Audit Committee had responsibility for risk oversight in connection with its review of our financial reports filed with the SEC. Our Audit Committee receivedBoard receives reports from our Chief Financial Officer and our independent auditors in connection with the review of our quarterly and annual financial statements regarding significant financial transactions, accounting and reporting matters, critical accounting estimates and management’s exercise of judgment in accounting matters. When reporting on such matters, our independent auditors also provide their assessment of management’s report and conclusions.

Succession Planning and Management Development

Until September 2018, our Compensation Committee oversaw and evaluated leadership succession planning practices and results. Until September 2018, our Compensation Committee reported annually to our Board of Directors on succession planning, including policies and principles for executive officer selection. Currently, our Board of Directors oversees and evaluates succession planning practices and results.results and all other former compensation committee functions.

Review of Related Person Transactions

SEC rules require us to disclose certain transactions involving more than $120,000 in which we are a participant and any of our directors, nominees as directors or executive officers, or any member of their immediate families, has or will have a direct or indirect material interest. The charter of our Audit Committee requires the committee toOur Board must review and approve or ratify any such “related person transaction” that is required to be disclosed. ThereOther than Backstop Agreement (defined and described below under “Certain Relationships and Related Transactions, and Director Independence”), there have been no transactions or proposed transactions requiring review during fiscal 2018year 2020 and through the date of the mailing of this proxy statement.

| 17 |

The Board has delegated to Messrs. Casabonne, Chernicoff and Stewartthe independent members of the Board the responsibility to review and approve all transactions or series of transactions in which we or a subsidiary is a participant, the amount involved exceeds $120,000 and a “related person” (as defined in Item 404 of Regulation S-K) has a direct or indirect material interest. Transactions that fall within this definition will be referred to Messrs. Casabonne, Chernicoff and Stewartthe independent members of our Board for approval, ratification or other action. Based on its consideration of all of the relevant facts and circumstances, such Directorsdirectors will decide whether or not to approve the transaction and will approve only those transactions that are in theour best interests of the Company.interests.

Board Access to Senior Management, Independent Accountants and Counsel

Directors have complete access to our independent registered public accounting firm, senior management and other employees. They also have complete access to counsel, advisors and experts of their choice with respect to any issues relating to our Board of Directors’Board’s discharge of its duties.

Retirement Policy

We have not established a boardBoard retirement policy.

Committees of our Board of Directors

Our Board has two separately designated committees: our Audit Committeecommittees, an audit committee and our Compensation Committee neithera compensation committee, each of which isdoes not currently occupied.have any members or activities separate from the Board. It is the intention of the Board to form a separate Audit Committeereconstitute the audit committee and Compensation Committee in accordance withcompensation committee when required by the standards established by Nasdaq.complexity of the business or legal or listing requirements. Our Board has determined not to establish a Nominatingnominating committee. Nominees for election as directors are selected by our Board.

Audit Committee

Until September 2018, our Audit Committeeaudit committee reviewed our internal accounting procedures and considers and reports to our Board of Directors with respect to other auditing and accounting matters, including the selection of our independent auditors, the scope of annual audits, fees to be paid to our independent auditors and the performance of our independent auditors. Our Audit Committeeaudit committee relied on the expertise and knowledge of management and the independent auditors in carrying out its oversight responsibilities. On a routine basis, our Audit Committeeaudit committee met separately with our independent auditors and invites select employees who work under the Chief Financial Officer to participate in its meetings. Our Audit Committeeaudit committee charter requires that each of the members of our Audit Committee isaudit committee be independent, as defined under SEC rules and Nasdaq listing standards, and that at least one member of our Audit Committee hasaudit committee have past employment experience in finance or accounting, requisite professional certification in accounting, or other comparable experience or background which results in the individual’s financial sophistication, including having been a chief executive officer, chief financial officer, or other senior officer with financial oversight responsibilities. The responsibilities and activities of our Audit Committeeaudit committee are described in greater detail in our Audit Committee charter.audit committee charter; however, currently, the functions of the audit committee are served by the Board, in particular our independent directors on the Board.

Compensation Committee

Until September 2018, the Compensation Committeecompensation committee of our Board of Directors acted on behalf of our Board of Directors to review, adopt and oversee our compensation and employee benefit programs and practices, including, but not limited to:practices. Currently, the functions of the compensation committee are served by the Board, in particular our independent directors on the Board.

For executives other than our Chief Executive Officer, our Compensation Committee considerscompensation committee considered evaluations and recommendations submitted to our Compensation Committeecompensation committee by our Chief Executive Officer on which compensation determinations arewere then made. In the case of our Chief Executive Officer, the evaluation of his or her performance iswas conducted by our Compensation Committee,compensation committee, which determinesdetermined whether, and if so in what manner, to recommend to the full Board of Directors any adjustments to his or her compensation as well as awards to be granted. Our Compensation Committeecompensation committee does not determine non-employee director compensation.

Each member of our Compensation Committee is currentlycompensation committee was a “non-employee” director as defined under Section 16 of the Exchange Act. Our Compensation Committee operatescompensation committee operated under a written charter adopted by our Board, of Directors, a current copy of which is available in the corporate governance section of our website at www.hopto.com.

| 18 |

The charter of our Compensation Committee providescompensation committee provided that any independent compensation consultant engaged by our Compensation Committeecompensation committee works for our Compensation Committee,compensation committee, not our management, with respect to executive and director compensation matters.

Director Nominations and Qualifications for Director Nominees

Our Board does not have a nominating committee. Our Board has determined that given its relatively small size, the function of a nominating committee could be performed by our Board as a whole without unduly burdening the duties and responsibilities of our Board members. The nomination of each of the director nominees standing for election at the Annual Meeting was unanimously approved by our Board.

Our Board does not have written guidelines regarding the qualifications or diversity of properly submitted candidates for membership on our Board. Qualifications for consideration as a new director nominee may vary according to the particular areas of expertise being sought as a complement to the existing Board composition. In reviewing nominations, our Board will consider, among other things, an individual’s business experience, industry experience, financial background, breadth of knowledge about issues affecting us, time available for meetings and consultation regarding company matters and other particular skills and experience possessed by the individual.

Communications with our Board of Directors

Stockholders and other interested parties may contact any member (or all members) of our Board of Directors (including, without limitation, the non-management directors as a group), any committee of our Board of Directors or the Chair of any such committee by mail. All such correspondence may be sent addressed to our Board, of Directors, any committee or any individual director, c/o Corporate Secretary, HopTo, Inc., 6 Loudon Road,189 N. Main Street, Suite 200,102, Concord NH 03301.

All stockholder communications will be opened and reviewed by the Corporate Secretary for the sole purpose of determining whether the contents represent a message to the directors. Any contents that are not in the nature of advertising, promotions of a product or service, or patently offensive material will be forwarded promptly to the addressee. In the case of communications to our Board of Directors or any group or committee of directors, the Corporate Secretary will make sufficient copies and send one copy to each director who is a member of the group or committee to which the envelope is addressed.

Compensation CommitteeBoard Interlocks and Insider Participation

None of our independent directors during fiscal 2018:2020:

| ● | was an officer or employee of ours or any of our subsidiaries; | |

| ● | was formerly an officer of ours or any of our subsidiaries; or | |

| ● | (except as described herein) had any relationship requiring disclosure by us under the SEC’s rules requiring disclosure of related party transactions in this proxy statement. |

DelinquentDelinquent Section 16(a) Reports

Pursuant to Section 16(a) of the Exchange Act, our directors and executive officers, and any persons holding more than 10% of our common stock, are required to report their beneficial ownership and any changes therein to the SEC and to us. Specific due dates for those reports have been established, and we are required to report herein any failure to file such reports by those due dates. Based solely on a review of copies of such reports and written representations delivered to us by such persons, we believe that during the fiscal year ended December 31, 2018,2020, all Section 16(a) filing requirements applicable to the executive officers, directors and stockholders were timely satisfied.satisfied, except those that were unintentionally filed late due to administrative delays.

| 19 |

Certain Relationships and Related Transactions, and Director Independence

Our Amended and Restated Certificate of IncorporationCharter, Bylaws and indemnification agreements with our directors and executive officers obligate us to indemnify our directors and executive officers. We have also purchased director and officer indemnification insurance.

Our Code of Conduct provides our written policies and procedures for the review of any activities by a director, executive officer or employee or members of their immediate families which create or appear to create an actual or potential conflict between the individual’s interests and our interests. Our Audit Committeeaudit committee (or our Board in lieu thereof) is responsible for interpreting our Code of Conduct, reviewing reports of alleged breaches of such Code of Conduct and granting waivers of or approving amendments of such Code of Conduct. Our Audit Committeeaudit committee (or our Board in lieu thereof) is responsible for reviewing past or proposed transactions between us and related persons.

Our Code of Conduct requires all of our employees, executives, directors, agents and representatives, including contractors and contingent workers, to avoid any activity or personal interest that creates or appears to create a conflict of interest with us, and requires all of our personnel to disclose any such activity or interest to management. Our employees and directors must disclose any relationship with outside firms where they have any influence on transactions involving purchases, contracts or leases with such firm. Employees are directed to report such potential or actual conflicts to their supervisors, the Chief Financial Officer or Chief Executive Officer, and management is directed to review and make a report to the Chief Financial Officer or Chief Executive Officer. Our Chief Financial Officer or Chief Executive Officer or his/her designee then reviews the situation, and if an actual conflict of interest exists, must disclose such facts and circumstances to our Audit Committee,audit committee (or our Board in lieu thereof), which oversees treatment of such issues and reviews and resolves the individual matters presented.

Our directors and executive officers are required to obtain the prior written approval of our Audit Committee,audit committee (or our Board in lieu thereof), or its designated member, following the full disclosure of all facts and circumstances before making any investment, accepting any position or benefits, or participating in any transaction or business arrangement that creates or appears to create a conflict of interest.

| Name | Age | Position | ||

| Jonathon R. Skeels | Chief Executive Officer and interim Chief Financial Officer |

Jonathon R. Skeels.For biographical information on Mr. Skeels, see “Proposal 1: Election of Directors.”